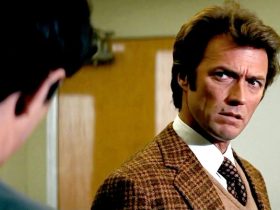

Shaktikanta Das, governor of the Reserve Financial institution of India (RBI), throughout an occasion on the Peterson Institute of Economics (PIIE) in the course of the annual conferences of the Worldwide Financial Fund (IMF) and World Financial institution in Washington, DC, US, on Friday, Oct. 25, 2024.

Bloomberg | Bloomberg | Getty Photographs

Central banks have managed to engineer a comfortable touchdown by means of a interval of “continuous and unprecedented shocks,” however there may be nonetheless a danger of worldwide inflation returning and of financial progress slowing down, in keeping with India’s central financial institution chief.

Talking Thursday in Mumbai, India, at CNBC-TV18’s International Management Summit, Reserve Financial institution of India (RBI) Governor Shaktikanta Das stated financial coverage from international central banks had largely “carried out effectively” lately regardless of conflicts, geopolitical tensions and better volatility.

“A comfortable touchdown has been ensured however dangers of inflation — as I communicate to you right here right now — dangers of inflation coming again and progress slowing down do stay,” Das stated.

“The headwinds from the geopolitical conflicts, geoeconomic fragmentation, commodity worth volatility and local weather change proceed to develop.”

Das pointed to a number of contradictions in international markets to underline his view, together with the appreciation of the U.S. greenback, even because the Federal Reserve is reducing rates of interest.

The U.S. greenback index, which measures the foreign money in opposition to six prime counterparts together with the euro and yen, added 0.2% to 106.71 as of 8:45 a.m. London time on Thursday, briefly notching its highest stage since November final 12 months.

U.S. greenback index during the last 12 months.

It comes as buyers and economists scrutinize what President-elect Donald Trump’s return to the White Home may imply for U.S. rates of interest.

The prospect of upper commerce tariffs and tighter immigration coverage beneath a second Trump presidential time period is predicted to gasoline inflation, which may in flip put the brakes on the Fed’s rate-cutting cycle over the long term.

The Fed delivered its second consecutive rate of interest reduce earlier within the month, in keeping with expectations, and merchants see a respectable likelihood of one other trim in December.

Divergent themes in international markets

“Authorities bond yields are rising whilst many superior economies have embarked upon an easing path by means of price cuts, underscoring the truth that Treasury markets are influenced by a bunch of worldwide and home elements which can be a lot past mere coverage changes,” Das stated.

“Second, undeterred by the robust U.S. greenback and excessive bond yields, costs of gold and oil, the 2 commodities that usually transfer in tandem, are displaying sharp divergence,” he continued.

“Third, an attention-grabbing distinction can be rising between rising geopolitical dangers and monetary market volatility, whereas geopolitical tensions have escalated steadily lately, monetary markets have proven appreciable resilience within the face of mounting uncertainties.”

A laborer hundreds shopper items onto a provide cart at a wholesale market in Kolkata, India, on November 11, 2024.

Nurphoto | Nurphoto | Getty Photographs

Das famous that international commerce is projected to stay increased this 12 months in comparison with 2023, however the challenges posed by tariffs, sanctions, import duties, cross-border restrictions and provide chain disruptions.

Turning to India’s economic system, Das stated the nation’s progress price stays resilient and predicted that inflation would reasonable “regardless of periodic humps.”

He added, “The Indian economic system has sailed very effectively by means of the extended interval of turbulence, and it reveals resilience within the face of regularly rising new challenges.”

Rates of interest

Talking throughout a separate session at CNBC-TV18’s International Management Summit, Piyush Goyal, India’s Union Minister of Commerce known as on the nation’s central financial institution to ease financial coverage to spice up financial progress.

Requested whether or not the RBI ought to trim rates of interest subsequent month, Goyal replied, “I definitely consider they need to reduce rates of interest. Development wants an extra impetus. We’re the quickest rising economic system on the planet [but] we are able to do even higher.”

The RBI held the important thing rate of interest regular at 6.5% in October, whereas altering its coverage stance to “impartial”, bolstering hopes the central financial institution might quickly be ready to decrease borrowing prices.

RBI’s Das stated he would chorus from any feedback on a December price transfer.